Generational wealth, a concept often associated with financial prosperity passed down from one generation to the next, has long been an aspiration for families in New York and beyond. In today’s rapidly changing economic landscape, the pursuit of generational wealth has taken on renewed significance. As we navigate the complexities of investing, saving, and planning for the future, it becomes crucial to seek out strategies and resources that can help us build a strong financial foundation for ourselves and our loved ones.

In 2016, as individuals sought ways to enhance their financial well-being, many turned to educational programs like Penn Foster for guidance. With its comprehensive curriculum and emphasis on practical knowledge, Penn Foster provided students with valuable insights into various fields of study. From business management to finance and accounting, these programs equipped learners with the tools they needed to succeed in today’s competitive job market.

As I reflect upon the year 2016 and its impact on individuals’ pursuit of generational wealth in New York, I’m reminded of the importance of education as a catalyst for progress. Through platforms like Penn Foster, people were empowered to acquire new skills and expand their knowledge base. By taking advantage of such opportunities, individuals positioned themselves more favorably within their careers – ultimately laying a solid foundation for building generational wealth.

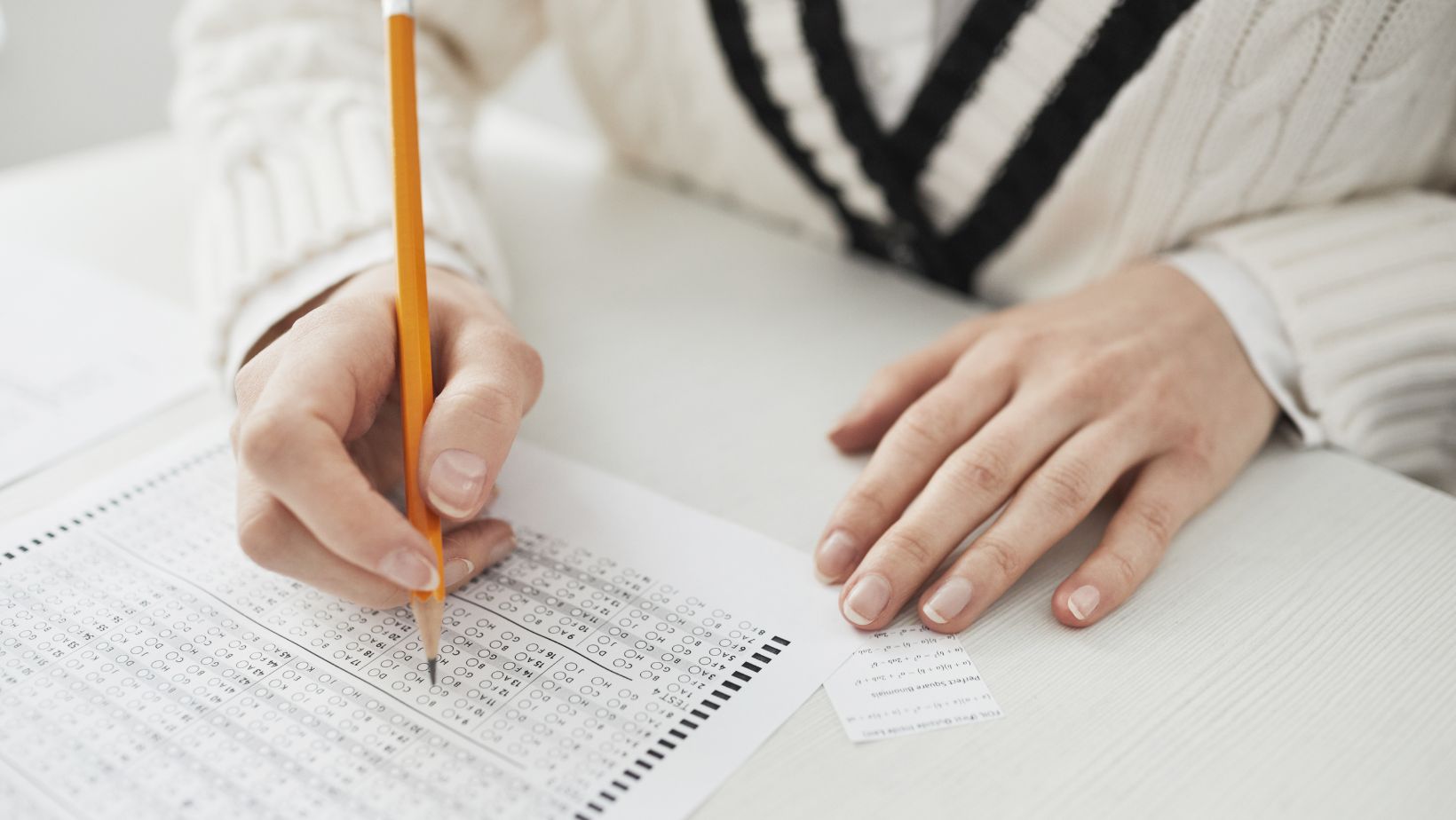

Penn Foster Exam Answers 2016

When it comes to building generational wealth, New York has always been at the forefront. With its bustling financial markets and diverse range of opportunities, this vibrant city offers countless avenues for individuals and families to secure their financial future.

In 2016, understanding the basics of how to navigate these opportunities is crucial. From investing in real estate to starting your own business, taking advantage of tax incentives to maximizing retirement savings, having a solid foundation of knowledge is key.

Let’s delve into some key aspects that can help you on your journey towards creating generational wealth in New York:

- Real Estate Investments: The New York property market holds immense potential for long-term wealth accumulation. Whether it’s purchasing residential properties or commercial spaces, investing smartly in real estate can provide steady income streams and substantial appreciation over time.

- Entrepreneurship: New York City is a hotbed for entrepreneurship and innovation. Starting your own business not only allows you to be in control of your financial destiny but also opens up possibilities for exponential growth and success.

- Tax Planning Strategies: Understanding the intricacies of New York’s tax laws can significantly impact your ability to accumulate wealth over generations. Exploring tax incentives and utilizing effective strategies can lead to substantial savings and increased investment opportunities.

- Retirement Planning: Securing a comfortable retirement is essential when building generational wealth. Taking advantage of retirement accounts like IRAs (Individual Retirement Accounts) or 401(k)s allows you to grow your nest egg over time through compounding interest and favorable tax benefits.

- Education and Networking: In such a dynamic city like New York, staying informed about the latest trends, attending seminars or workshops, and networking with like-minded individuals are invaluable assets in gaining knowledge and uncovering new opportunities.

By focusing on these fundamental pillars of wealth creation, you’ll be well-equipped to pave the way for future generations to thrive financially. New York’s vibrant and ever-evolving landscape offers endless possibilities for those who are willing to learn, adapt, and seize the opportunities that come their way.

.

Brian, the dedicated Editor and Education Enthusiast at Faspe, is a dynamic force breathing life into the realm of education. Grounded in pedagogical expertise and fueled by boundless passion, Brian enriches the team with extensive experience, curating resources that inspire educators and students alike. His unshakable faith in the transformative power of education propels individuals to reach for the stars on their educational journey.